Over the last few years, various sectors have experienced significant transformations by adopting technology to streamline operations and improve efficiency. However, considering it is considered very conservative, the insurance industry needs to adjust much faster.

Imagine a time before the internet, when insurance agents sifted through mountains of paperwork to assess risk and determine your insurance premiums. This was how things were done not long ago during an underwriting process. Nonetheless, thanks to technology today, underwriting systems insurance has experienced major changes due to increased efficiencies.

However, what exactly is underwriting, and how do these systems evolve? Let’s take a trip through time and see how insurance companies assess risk, which has changed.

Understand Insurance Underwriting

Before getting into improvements made by technology, let us get a grip on what entails underwriting as far as insurance goes, as you likely remember from our previous discussions concerning payment protection policies.

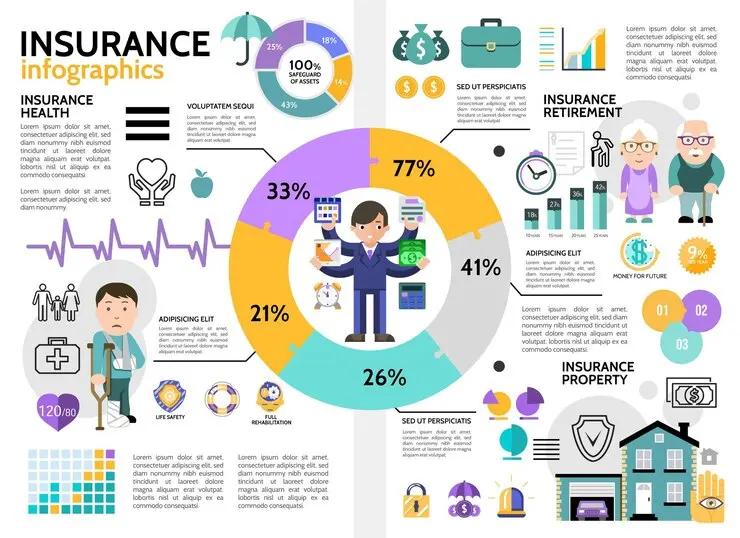

Underwriters dedicate 40% of their time to non-essential tasks, leading to an efficiency loss estimated between $85 and $160 billion over the next five years.

Insurance companies are businesses or organizations primarily driven by profit motives and, therefore, depend on underwriters who decide whether it is financially viable for them to provide coverage to a client. Underwriters evaluate the amount of risk involved, the chances of something going wrong, as well as potential claims costs.

Based on this assessment, they determine the premiums clients need to pay. For example, a smoker applying for health insurance would typically face higher premiums due to the associated health risks.

The Shift to Automated Underwriting

Automated underwriting has been revolutionary for the insurance industry. They make use of AI-driven expert systems to streamline the process of underwriting, making it more efficient and accurate.

These expert systems contain thousands of underwriting rules that evaluate the risk of insuring different clients. These systems become more advanced with technology, integrating machine learning algorithms into identifying new risk patterns. Furthermore, insurance firms are now taking advantage of big data to counter emerging risk assessment issues.

However, we may witness a complete transition from human underwriters to AI-driven systems in the future. Although AI must still be well advanced enough to handle highly complex cases like those involving intricate medical histories, it has greatly improved the underwriting process. For instance, AI can extract relevant sections from lengthy reports, and integrate them, thereby reducing manual labor and minimizing mistakes.

The Age of Big Data

In recent years, there has been an explosion of available data, which has had a profound effect on the insurance industry. Now, it allows us to review various policies offered by different companies.

Insurance companies can collect and analyze large volumes of data through public records, social media, and wearable devices, among other sources. As such, this big data gives insights about risks that are too subtle for insurers, allowing them to create customized products targeting individual needs.

The Rise of AI – Automating Risk Assessment

However, the most exciting thing happening in the world of underwriting systems today is artificial intelligence (AI). AI algorithms can analyze massive data sets, thus enabling them to detect patterns humans may overlook.

As a result, premiums for everyone become fairer due to more objective and accurate risk assessment. To illustrate, AI’s examination of driving habits can influence vehicle insurance premiums.

Higher rates may apply to drivers who frequently brake or make a lot of sharp turns due to the increased risk. Nonetheless, AI can also consider your car model and traffic patterns in your area, presenting a more holistic perspective of your exposure.

The Future of Underwriting Systems

Though artificial intelligence gains more ground in underwriting, it must be realized that human expertise remains critical. Underwriters will remain pivotal figures during this process, using their knowledge and reasoning to decipher this data and make complex decisions. The future of underwriting systems is likely going to be a joint effort between humans and machines.

Thus, AI will do much of the heavy lifting when analyzing data, while human insurance underwriters focus on utilizing their experience in making key decisions. This collaboration shall ensure that these insurers’ fair policies are consistent with accuracy.

Conclusion

The insurance industry is on the brink of a significant transformation. AI and big data have seen underwriting, a core aspect of insurance, experience monumental changes. These developments make underwriting more efficient, precise, and customer-oriented. Going forward, human underwriters will take on roles that involve complicated cases necessitating discerning decisions. The future of insurers’ underwriting systems is undoubtedly digitalized; therefore, embracing these changes would be critical for companies’ survival against competition and meet changing c